Property investment has long been a staple in British retirement planning.

The introduction of the buy-to-let mortgage over a quarter-century ago marked a significant turn, presenting opportunities for dual returns: rental income in the short-term and capital growth in the long-term. You can see why there are a substantial number of Kenilworth landlords who view property investment as a cornerstone of their retirement strategy.

However, this path is full of challenges. Recent shifts in tax and regulatory landscapes, coupled with escalating interest rates, have imposed pressures on profitability, compelling some landlords to reconsider their positions. Thus, becoming a landlord in Kenilworth necessitates meticulous research and a strategic approach.

The Foundations of Buy-to-Let Mortgages in Kenilworth

A critical step in this venture is securing a buy-to-let mortgage, a process distinct from obtaining a homeowner loan. Lenders assess buy-to-let applicants based on an interest-coverage ratio (ICR), which demands that rental income meets or exceeds a certain percentage of the monthly mortgage interest (a minimum of 125% for standard taxpayers and 145% for higher-rate taxpayers). Additionally, many lenders require that buy-to-let borrowers have a minimum annual income outside of rental earnings to mitigate dependence on rental income.

Regarding the initial investment, a typical deposit hovers around 25% of the property's value. The borrowing landscape has experienced upheavals with the Bank of England's recent base rate increases. However, the average rate for a five-year fixed buy-to-let mortgage has witnessed a reduction in rates recently. For example, at the time of writing, HSBC has a 5-year BTL mortgage at 4.84% with a 75% Loan to Value (i.e. you put down a 25% deposit) with an arrangement fee of £1,999. Prospective Kenilworth landlords must judiciously consider these factors, evaluating the sustainability of their investment against potential interest rate hikes.

Understanding Costs and Preparations

The financial commitment extends beyond the deposit. Prospective landlords in Kenilworth should account for additional expenses like stamp duty, which includes a 3% surcharge for second homes. Furthermore, maintaining a contingency fund for maintenance and unforeseen rental voids is prudent. It's advisable to earmark approximately 1% of the property’s value annually for repairs and upkeep.

Navigating the Buy-to-Let Landscape

Investment in Kenilworth buy-to-let properties is not merely a financial decision but also an emotional one. Landlords must be prepared for the demands of property management, ranging from addressing maintenance issues to dealing with tenant-related challenges. The complexity of landlord responsibilities is underscored by over 150 pieces of legislation governing the sector, a figure poised to rise with impending regulations.

Demand & Supply of Kenilworth Rental Properties

The Kenilworth rental market has experienced a sustained period of significant rental inflation over the past few years. Despite that, Zoopla recently stated that demand for rental properties on its portal was 51% higher in Q3 2023 than the five-year average.

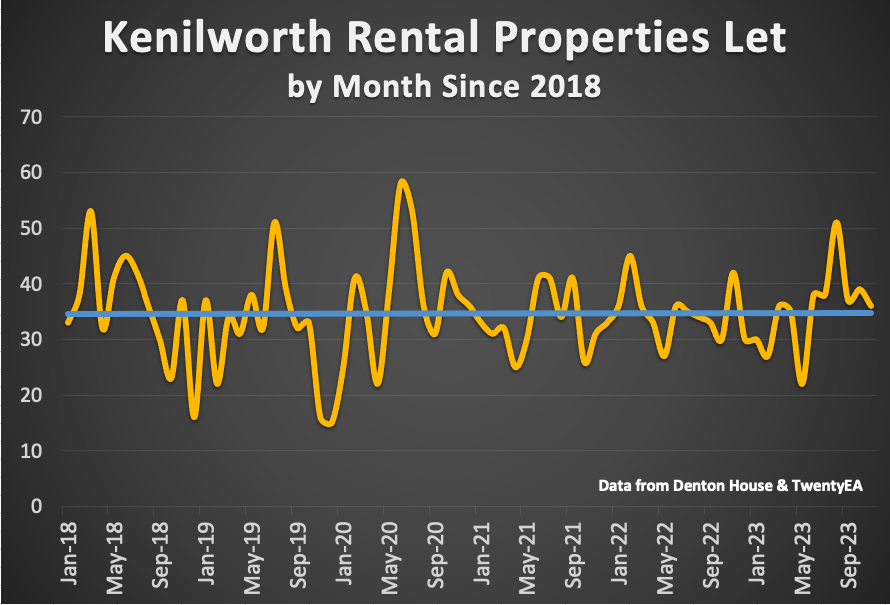

In the Kenilworth area (CV8), the numbers of properties being let over the last six years are as follows.

In 2018, an average of 36 properties were let per month in the Kenilworth area.

In 2019, an average of 32 properties were let per month in the Kenilworth area.

In 2020, an average of 38 properties were let per month in the Kenilworth area.

In 2021, an average of 33 properties were let per month in the Kenilworth area.

In 2022, an average of 35 properties were let per month in the Kenilworth area.

In 2023, an average of 35 properties were let per month in the Kenilworth area.

However, even though demand is higher, the long-term supply of rental properties coming onto the market in the Kenilworth area has remained static, which can only mean rents will continue to grow as they have for the last couple of years.

This ongoing imbalance between supply and demand is a consistent characteristic of the rental market throughout all regions and countries in the UK. Currently, the annual rent growth rate in the UK stands at just over 10%. It's not good news for tenants, yet it still makes buy-to-let financially viable for most Kenilworth landlords, especially as interest rates have risen significantly in the last few years.

Rent Adjustments and Tenant Relations in Kenilworth

For landlords, understanding the regulations surrounding rent increases is crucial. These rules vary depending on the tenancy type, with periodic tenancies allowing for annual rent reviews. Ensuring transparent communication and fair practices in rent adjustments can foster harmonious landlord-tenant relationships.

The Eviction Process: A Delicate Matter

Eviction is a process governed by strict legal parameters. The anticipated changes in the Renters’ Reform Bill, particularly concerning Section 21 evictions, are set to alter the landscape, emphasizing tenant protection. Landlords must be well-versed in these regulations to navigate tenant eviction legally and ethically.

Conclusion: The Role of Expertise in Property Investment

Having a knowledgeable and experienced guide is invaluable in the intricate world of property letting. As a seasoned agent in Kenilworth, we offer a wealth of expertise and insight, making us the ideal partner for both novice and experienced landlords.

Whether navigating the complexities of buy-to-let mortgages, understanding the nuances of property investment in Kenilworth, or managing tenant relationships, our proficiency is a vital resource for anyone looking to explore or deepen their involvement in the property market.

In conclusion, the journey to becoming a landlord, especially in a market like Kenilworth, rewards careful planning, informed decision-making, and strategic foresight. With the guidance of seasoned professionals like us, Kenilworth landlords can navigate the challenges and complexities of the property market, ensuring their investment not only endures but thrives.

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link